Life cover

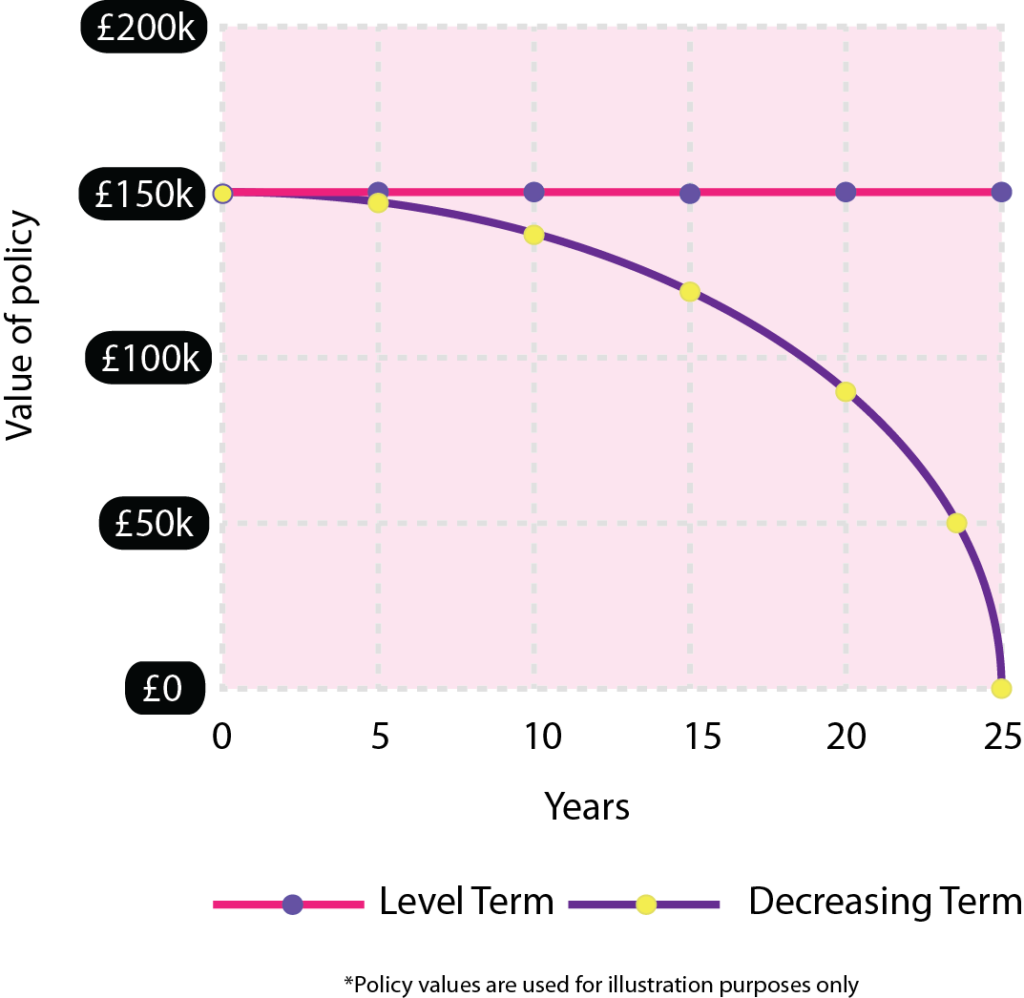

The simplest and most affordable form of protection, you will receive a payout if you die within a predefined policy term. There are different types of term assurance available which pay out a fixed amount, decreasing, level or increasing.

Decreasing policies pay out a smaller amount as time passes meaning the longer you have the policy the smaller amount you will receive should you die within the term of the policy, typically people arrange for this to fall in line with their outstanding mortgage balance to ensure the mortgage is paid off should they die before the balance is cleared. A decreasing policy is typically cheaper than other forms of policy as the payout is potentially smaller.

Decreasing policies pay out a smaller amount as time passes meaning the longer you have the policy the smaller amount you will receive should you die within the term of the policy, typically people arrange for this to fall in line with their outstanding mortgage balance to ensure the mortgage is paid off should they die before the balance is cleared. A decreasing policy is typically cheaper than other forms of policy as the payout is potentially smaller.

Family income benefit plans offer a level or increasing monthly income to dependents. Most policies require you to be aged between 18 to 89 and the policy must end before you are 90 years old.

How much does life cover cost?

| Age | Average Monthly Premium |

|---|---|

| 16-24 | £6.60 |

| 25-34 | £12.28 |

| 35-44 | £18.28 |

| 45-54 | £22.38 |

| 55-64 | £24.34 |

*figures above for level term, life-only (without critical illness cover) single person policies. (Source: MoneySuperMarket data July 2019 to June 2020.)

Critical illness

Critical illness cover provides a tax-free lump sum of money if you are diagnosed with a serious medical condition within the term of the policy. The cover available varies depending on the policy but most cover in the region of 50 conditions including; heart attacks, cancer, strokes and conditions such as Multiple Sclerosis.

Income protection

Income Protection Cover pays a regular percentage of your pre-disability earnings if you are unable to work due to sickness or illness. The policy will make payments until you are able to return to work, you reach retirement or the policy term ends (whichever is the soonest).

When applying for income protection it is medically underwritten so you know what exactly is covered before the policy starts. This means there is no confusion or uncertainty should you need to make a claim.

When applying for income protection it is medically underwritten so you know what exactly is covered before the policy starts. This means there is no confusion or uncertainty should you need to make a claim.

Whole of life cover

Whole of life cover pays a lump sum when you die, whenever this may be. There is no age cap on when the policy will pay out (unlike term assurance) meaning whenever you die the policy will payout.

Whole of life cover policies are more expensive than term assurance but do offer the certainty of a lump sum payment.

Whole of life cover policies are more expensive than term assurance but do offer the certainty of a lump sum payment.