Selecting and managing the correct investment strategy is vital to ensure your financial goals are met. No matter if you are looking to receive an income, growth or both, good investment advice is vital for a positive outcome. The investment advisers we work on behalf of can offer new investment advice and ongoing support to ensure your money is working well.

Perhaps you have an existing share portfolio that may benefit from a full review, different management approach, or you may be seeking new investment opportunities within your investment strategy. Working together with a qualified and regulated investment adviser can create and manage a bespoke share portfolio which is built to match your risk profile and meet any specific investment requirements.

Perhaps you have an existing share portfolio that may benefit from a full review, different management approach, or you may be seeking new investment opportunities within your investment strategy. Working together with a qualified and regulated investment adviser can create and manage a bespoke share portfolio which is built to match your risk profile and meet any specific investment requirements.

3 Things to consider before investing

Should I invest?

Do you have enough money saved for emergencies before committing to investments.

How much should I invest?

Consider how much you would like to invest comfortably to reach your goals.

Where should I invest?

You should consider how risk-averse you are and how ethical an investment you would like to make.

The value of investments and any income they generate can go down as well as up, meaning you may not get back what you invest. You can access your money if you need to, however, you should consider investing for at least 5 years.

What can I invest in?

You can invest in anything, some of the mainstream investments include:

There are also more exotic investments which include:

ISAs

Individual savings accounts (ISAs), let you save money and earn interest on up to £20,000 without paying any tax on what you earn. You receive an allowance for every tax year (currently the allowance is £20,000), which you can put into a number of different types of ISA.

Investment Bonds

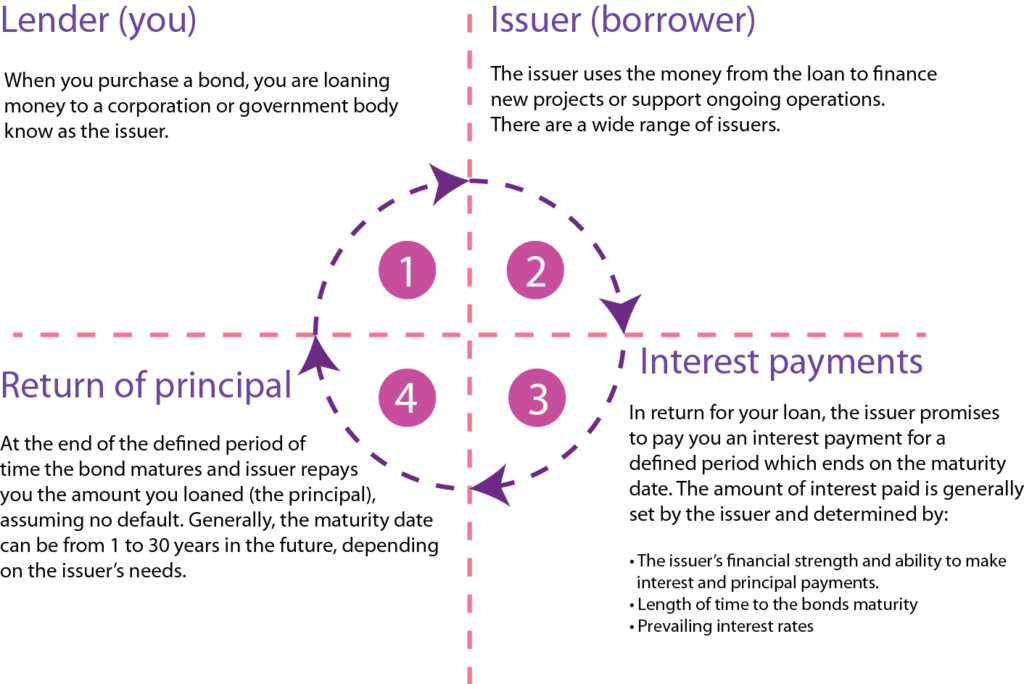

How do investment bonds work?

Bonds are issued by governments and corporations when they want to raise money. By buying a bond, you're giving the issuer a loan, and they agree to pay you back the face value of the loan on a specific date, and to pay you periodic interest payments along the way, usually twice a year.

Bonds are issued by governments and corporations when they want to raise money. By buying a bond, you're giving the issuer a loan, and they agree to pay you back the face value of the loan on a specific date, and to pay you periodic interest payments along the way, usually twice a year.

A word of caution

Investing can be risky, the rewards can be great, but you could lose all your money. All investments come with the following warning 'Past performance is no indicator of future success'. Getting good advice should negate some of the risks and potentially give you a better outcome. You should also be extra cautious when considering unregulated investments as they are not subject to the same scrutiny and controls that regulated investments are.

Get investment advice >>